2 Available Offers

Show Only

Offer Type

Efile Overview

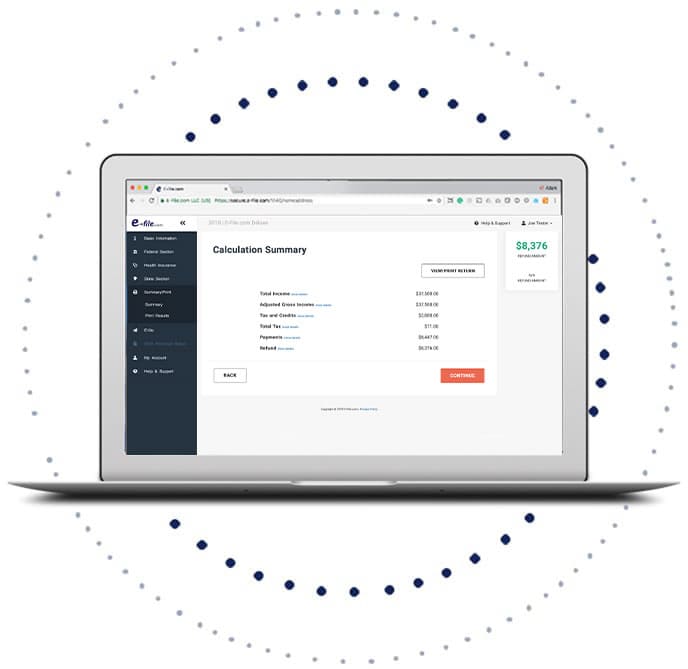

E file A Guide to Online Tax Filing In the era of digital convenience, filing taxes online has become increasingly popular. E file stands as one of the prominent platforms in this realm, offering taxpayers a user friendly and efficient way to navigate the often daunting process of tax preparation. From its inception, E file has aimed to simplify tax filing while providing reliable services for individuals and businesses alike.

| Coupon codes: | 2 |

| Deals: | 0 |

| Last updated: | Dec 07, 2025 |

Efile Overview

E file A Guide to Online Tax Filing In the era of digital convenience, filing taxes online has become increasingly popular. E file stands as one of the prominent platforms in this realm, offering taxpayers a user friendly and efficient way to navigate the often daunting process of tax preparation. From its inception, E file has aimed to simplify tax filing while providing reliable services for individuals and businesses alike.

| Coupon codes: | 2 |

| Deals: | 0 |

| Last updated: | Dec 07, 2025 |

Efile Coupon & Promo Code

Efile Coupon & Discount Code:

E-filing has become the go-to method for many individuals and businesses when it comes to filing taxes. It's quick, convenient, and offers a range of benefits over traditional paper filing. To make this process even more appealing, services like E-file offer coupon codes that can provide users with discounts and incentives, making tax season a bit more manageable on the wallet. find the coupon codes official website or on this page.

How to use E-filing Coupon code?

Visit E-file: Go to the E-file website and select the services you need, such as filing federal or state taxes, accessing customer support, or any other applicable services.

Start the Checkout Process: When you're ready to proceed, start the checkout process. Look for the "Checkout" or "Proceed to Checkout" button on the website.

Enter the Coupon Code: During the checkout process, you'll come across a field labeled something like "Enter Coupon Code" or "Promo Code." Paste the copied coupon code into this field.

Apply the Code: After pasting the coupon code, look for a button nearby that says "Apply" or "Submit." Click this button to apply the code to your order.

Verify the Discount: Once you've applied the coupon code, the discount or benefit associated with the code should be reflected in your order total. Verify that the discount has been applied correctly before proceeding.

Complete the Transaction: If everything looks correct and the discount is applied as expected, continue with the checkout process. You may need to provide payment information if there are any remaining costs after the discount.

Review Terms and Conditions: Before finalizing your purchase, it's a good idea to review the terms and conditions of the coupon code. This includes checking for expiration dates, specific services the code applies to, minimum purchase requirements, and any other relevant details.

Finish and Enjoy: Once you've completed the transaction, you're all set! You've successfully used an E-file coupon code to save on your tax filing services. Now you can enjoy the benefits of the discount or additional features that came with the code.

Why does the Efile Coupon code is not working?

Expired Coupon: The most common reason for a coupon code not working is that it has expired. Coupon codes typically have an expiration date, and if you're trying to use a code past its expiration, it will not work. Always check the validity of the coupon before attempting to use it.

Incorrect Code Entry: It's easy to make a mistake when entering a coupon code manually. Make sure you've entered the code exactly as it appears, including any capitalization and special characters. Even a small mistake can render the code invalid.

Ineligible Items: Some coupon codes are specific to certain products or services. If you're trying to use a coupon code for a service that isn't eligible, it will not work. Check the terms and conditions of the coupon to ensure it applies to the items in your cart.

Minimum Purchase Requirement: Certain coupon codes may have a minimum purchase requirement. If your order total doesn't meet this minimum, the code will not apply. Review the terms of the coupon to see if there's a minimum spend amount.

One-Time Use: Many coupon codes are designed for single use only. If you've already used the code or someone else has used it before you, it will no longer be valid. Look for codes that are specifically labeled for multiple uses if you're trying to use them again.

Not Applicable to Your Account: Some coupon codes are targeted or linked to specific accounts. If the code is not applicable to your account for any reason, such as being a new customer code or a loyalty reward, it will not work.

Usage Limit Reached: Some coupon codes have a limit on the number of times they can be used overall. If the code has reached its usage limit, it will no longer work for anyone trying to apply it.

Coupon Code Already Applied: If you've already applied a different coupon code to your order, you may not be able to use another one. Most systems only allow one coupon code per transaction.

Which Services does Efile have:

Federal Tax Filing: E-file provides online software for individuals to file their federal income taxes. Users can easily prepare and file their federal tax returns electronically through the platform.

State Tax Filing: In addition to federal tax filing, E-file.com offers services for filing state income taxes. Users can select their state and file their state tax return seamlessly along with their federal returns.

Tax Extension Services: E-file allows users to file for a tax extension if they need more time to complete their tax return. This extension can give taxpayers an additional six months to file, though it doesn't extend the time to pay any taxes owed.

Amended Tax Returns: Users who need to make changes or corrections to a previously filed tax return can do so through E-file.com's amended tax return service. This is useful if there are errors or if new information needs to be included.

Deluxe Edition: E-file offers a Deluxe Edition of their tax filing software, which is designed for users with more complex tax situations. This edition includes additional features and support for deductions, credits, and other complexities.

Premium Edition: The Premium Edition of E-file.com's software is ideal for self-employed individuals and small business owners. It includes support for small business income and expenses, as well as additional tax forms and schedules.

Military Edition: E-file has a specialized Military Edition tailored to the unique tax situations of military personnel and their families. This edition covers military-specific deductions and benefits.

Additional Features: E-file offers various additional features and tools to enhance the tax filing experience. This includes a refund tracker to monitor the status of tax refunds, a deduction finder to uncover potential deductions and secure storage for tax documents.

FAQs about Efile Coupon Code:

Can I use more than one E-file coupon code on my order?

Generally, E-file allows only one coupon code to be used per transaction. If you have multiple coupon codes, choose the one that provides the best discount or benefit for your order.

Can I use an E-file coupon code if I'm using the free version of their tax software?

Coupon codes may have restrictions on the type of products they apply to. Some codes may not be valid for use with the free version of E-file.com's tax software. Review the terms of the coupon to see which products or services it can be applied to.

Can I use an E-file coupon code for multiple tax returns?

E-file coupon codes are generally applied per transaction. If you are filing multiple tax returns in one transaction, the coupon code should apply to the entire order. However, if you're filing separately, you may need to use the code for each transaction.

Can I stack E-file coupon codes for additional discounts?

E-file typically allows only one coupon code to be used per transaction. Attempting to stack multiple coupon codes for additional discounts may not work. It's best to choose the code that provides the highest discount for your order.